Nic Salts and Freebase

10ml bottles based on multibuy pricing.

I don’t know how to put this lightly…

UK vapers are about to see an increase in price on e-liquid that eclipses the increase brought on by the introduction of TPD restrictions back in 2016. This new 2026 ‘Vaping Product Duty’ or VPD for short promises to apply an excise duty on all e-liquids or vape juices regardless of if they contain nicotine or not.

It aims to do this by introducing ‘Vaping Duty Stamps’ which will be a legal requirement for all substances intended for vaping. This will include products like nic salts, shortfills, prefilled pods and potentially even ingredients for DIY like propylene glycol (PG) and vegetable glycerine (VG), though it’s still unclear how that will be enforced.

So let’s get into what you should expect to pay for each product once the tax comes into place on October 1st 2026.

The government will be imposing a flat duty of 22p per 1ml of e-liquid (i.e. £2.20 per 10ml). This duty will be placed on top of the manufacturer’s cost price of the product, and will be subject to the standard 20% VAT. This means on average an increase of over 100% across most vape products, but some product types will be affected more than others.

Current retail prices compared with minimum price increases at 22p per ml + VAT.

10ml bottles based on multibuy pricing.

100ml shortfill bottles based on multibuy pricing.

Device with 10ml refill container and 2ml prefilled pod.

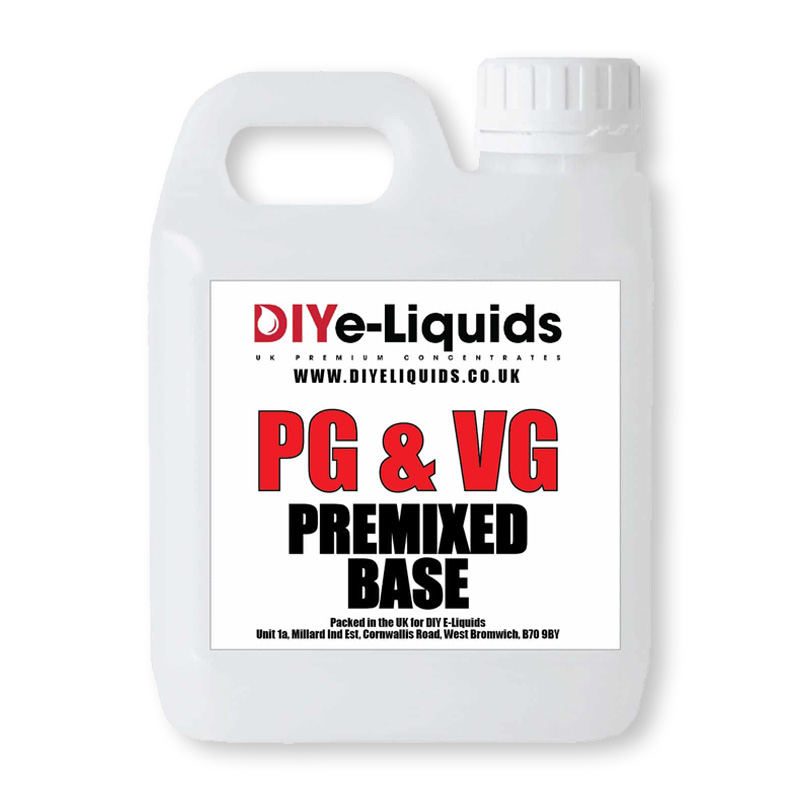

Base mix used for DIY E-liquids.

Please Note: These prices are approximate and only factor in the added new tax. Other factors could also contribute to the final price difference.

These prices will come as a shock to some (I know they did for me). It seems as though 10ml e-liquids and low capacity prefilled pods will become the only ‘affordable’ way to vape for many. 100ml shortfills will see an increase of at least 350% in price due to their large bottle size, which I imagine will kill this kind of product entirely.

Those who make their own vape juice (DIY liquids) could be the worst affected, since most VG/PG bases sold for the purpose of vaping are often sold in 1 litre containers, which could see an eye-watering increase of over 18 times the current price. Time will tell if these products will be affected in the same way as ready-made e-liquids, since these ingredients can be used for a multitude of other purposes.

As you can imagine, this news has shaken up the vape industry and has made a lot of people uncertain of what the future has in store. Even the figures I laid out before are only estimates based on the data available, they don’t factor in retail margins, increased manufacturing overheads, or any other pricing factors that could also increase the retail cost of e-liquid.

If you’re like me, you’re probably wondering, “why would the government do this?” After all, Public Health England and GPs across the country recommend vaping as a valid means to quit smoking and develop a less harmful habit.

The official reason as to why, is that it will ‘curb youth vaping’ - a sentiment echoed from the single use vape ban earlier this year. Whether to believe this “official reason” or not is up for debate, but as you may already know, the UK government has accrued over 2.6 trillion pounds of national debt as of October 2025, so call me cynical but maybe they are hoping the increased tax revenue can claw back some of the debt? A tiny sip from a very large bucket if you ask me.

If you look at the broader picture here too, the VPD is not something that’s come out of left field. The UK is simply following suit from other European countries like Poland, Germany and Belgium who have all imposed a similar duty on vape liquid. If anything we should count ourselves lucky -Lithuania for example tax their liquids at €0.63 per millilitre (around 55p!)

To wrap this up, I just want to say that though the future may seem uncertain right now, we as a company will continue to keep costs as low as possible for our customers, and will always do our very best to provide you with your favourite vaping supplies at an affordable price.